gTC Overview :

Founded in 2011, glendonTodd Capital is a Dallas-based private equity firm focused on healthcare services, business services and financial services companies, including correlated real estate. We invest in industries and geographies where our principals have significant operating experience, including direct P&L responsibility, strategic decision-making, deployment of expansion capital and operational responsibility.

Our investment thesis is simple: glendonTodd only invests where we have clear value creation strategies and actionable operational insights. Investing is not just “all about the math.” What we have seen is that projections based solely on quantitative factors can lead one down the wrong path. Because market conditions always evolve and operational insights matter, we continually look for the opportunities that this constant evolution presents. This approach informs our investment decisions; it shows us which assets to pursue and how to maximize value.

Why glendonTodd Capital?

gTC Approach :

glendonTodd Capital is a team of experienced and innovative professionals who specialize in highly regulated industries. Our mission is to provide guidance and value in areas where governance, compliance and precision are particularly critical.

We serve our investors, alongside management, with our experience, leadership, values and insight to accelerate the growth of the company and create long-term, sustainable value.

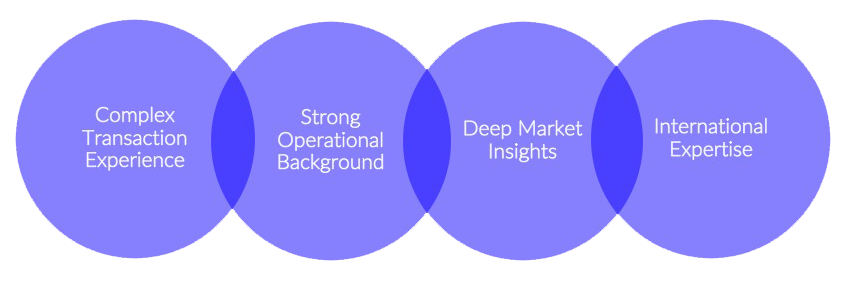

As a trusted partner, we provide our investors with the following:

• Deep industry knowledge and operating experience

• Proprietary tools for opportunity evaluation

• Governance, compliance and value-focused advice

• Complex transaction experience

• An advisory board comprised of industry leaders

• A team experienced in managing all stages in the continuum of risk

“I define judgment as the application of values to the fact pattern before you in order to make a decision. To be successful, you need to actually have values, know what they are and understand what they mean. The more and better we are acquainted with these values, the more viscerally we understand them. And, the more viscerally we understand them, the more rapidly we can make decisions based on them Todd Furniss

Our Values :

Professionalism, Integrity, Thoroughness, Collaboration, Confidentiality, Creativity, Communication, Curiosity

Our firm’s culture is exhibited by the disciplined application of our shared values.

We seek to work with people who exhibit good judgment, intellectual rigor, personal integrity and thought leadership in their industries. We encourage innovative ways of thinking and foster the exchange of well-thought-out ideas.

We believe that the value of a company is measured by more than just revenue.

That’s why we operate under the following principles of Conscious Capitalism:

- Focusing on the higher purpose of a business, not just on the profits

- Taking a stakeholder-centric approach to optimize long-term value

- Working with leaders who inspire new ways of thinking and nurture an engaged workforce by supporting the overall wellness of employees

- Fostering a culture of trust and care, thus creating value for all stakeholders